Just In

- 6 hrs ago

- 14 hrs ago

- 15 hrs ago

- 1 day ago

Don't Miss

- News

Ghazipur Landfill Fire: Massive Blaze Erupts At Delhi's Garbage Mountain | WATCH Video

Ghazipur Landfill Fire: Massive Blaze Erupts At Delhi's Garbage Mountain | WATCH Video - Sports

RCB IPL 2024 Playoff Scenario: Can Royal Challengers Bengaluru Qualify for the Playoffs after KKR Defeat?

RCB IPL 2024 Playoff Scenario: Can Royal Challengers Bengaluru Qualify for the Playoffs after KKR Defeat? - Finance

Missed Your Voter ID Card? Here Are 10 Alternate Documents You Can Use This Election Season!

Missed Your Voter ID Card? Here Are 10 Alternate Documents You Can Use This Election Season! - Movies

Love Sex Aur Dhokha 2 Cast Salary: HOW MUCH Was Mouni Roy Paid For Her CAMEO In LSD 2? GUESS The FEE -

Love Sex Aur Dhokha 2 Cast Salary: HOW MUCH Was Mouni Roy Paid For Her CAMEO In LSD 2? GUESS The FEE - - Lifestyle

World Earth Day 2024 Wishes, Greetings, Images, Twitter Status And Instagram Captions

World Earth Day 2024 Wishes, Greetings, Images, Twitter Status And Instagram Captions - Automobiles

Ensuring Car Fitness Ahead Of A Road Trip: Top Tips & Tricks You Need To Know

Ensuring Car Fitness Ahead Of A Road Trip: Top Tips & Tricks You Need To Know - Education

Assam Class 10 Result 2024 Declared: Anurag Emerged as the Top Performer With 593 Marks

Assam Class 10 Result 2024 Declared: Anurag Emerged as the Top Performer With 593 Marks - Travel

Journey From Delhi To Ooty: Top Transport Options And Attractions

Journey From Delhi To Ooty: Top Transport Options And Attractions

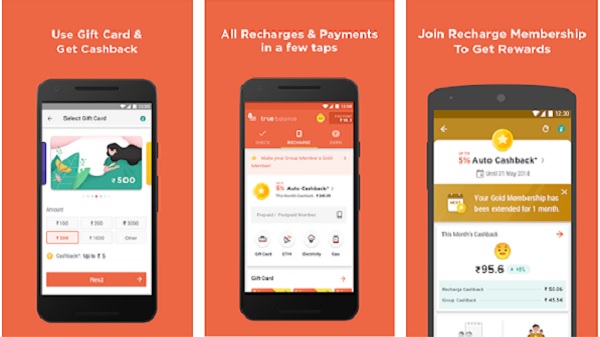

In conversation with True Balance: Aims to bring financial freedom to primarily unbanked users

True balance wants to add funds transfer and small-loans as mainstream products for Indian consumers.

People in India have widely accepted mobile wallets. As per a report published by data and analytics company GlobalData last year, India is one of the top markets globally in terms of mobile wallet adoption with 55.4% survey respondents indicating that they have a mobile wallet and use it in everyday routines.

The credit to this change goes to smartphone manufacturers and Indian telecom service providers. With 4G enabled smartphones available at affordable price-points, the mobile users have started relying on app-based transactions in addition to cash and debit/credit card use. Resultant, Indian economy now has all the three models; Cash, App-based, and Credit/Debit card.

The Indian market has some big established players such as Paytm and Google Pay, and new mobile wallets are also trying to gain a good market share by offering some extra features. One such mobile wallet is 'True Balance'. Launched in 2016, True Balance aims to bring financial freedom to primarily unbanked users. As per the data shared by the company, the app has garnered more than 60 million downloads and works to offer users a safe, fast and convenient transacting experience.

Moreover, the balance check app has gradually moved into utility payment and gift card ecosystem to offer some extra features to millennials. We at Gizbot interacted with Mr. Sean Yu, Vice President at Balancehero India Private Ltd, the parent company of True Balance to understand more about the gradually emerging mobile wallet. We wanted to understand what is the USP of True Balance and how the new mobile wallet will make its space in the Indian economy. Let's hear it from the Vice President at Balancehero.

What is the USP of True Balance? Why would someone use True Balance when the market already offers well-established apps like PayTm, Freecharge, etc?

The launch of wallet feature sees the app gradually progress from a "balance check app" to a "utility payment and gift card app. Recently, True balance partnered with BBPOU, an RBI conceptualized system, to facilitate quick and easy electricity and gas bill payments and added also DTH facility. Partnership with BBPOU will enable users to reap maximum benefits while making payments as well as gain an added advantage of True Balance features like Rate cutters, Smart alerts, and One Tap Recharge.

We are working towards getting a digitized economy and in our target area which is Rural India; cash is still the preferred mode. So, we constantly strive to create products catering to their needs; which set our context for small -loans for utility services.

The telecom operators have also started offering cash-backs for mobile bill payments made on their in-house apps. How is it affecting the popularity of True Balance and how are you fighting the competition?

The cash-back options by telecom operators help the market grow which in turn leads to more business opportunities and findings. Our goal is not to just give cash-backs but also expand the business by accumulating more users and providing financial services. We will do this by providing mobile payment services, small loans, mobile money transfers, etc., especially to unbanked users. In the larger picture, the mobile market will grow and eventually we will have to search for better services and products. India is currently having a thrust for digital solutions as the government is also taking the initiative to support this through various programmes. These would help us take this service to 1 million digital touchpoints which would further enable 100 million unbanked users by December 2018. Next year, we see our digital touchpoints spreading to 10 million and live our vision of touching "next billion users "by Dec 2019.

We see ourselves as an enabler to provide full-fledged financial services to Next Billion Users and inching closer to the dream of digital India. We intend to deliver value to our users, employees and our stakeholders and investors.

How do you plan to achieve these goals in the coming years?

We foresee to do this by expanding our current base of locally placed digital touchpoints and creating cutting-edge secure financial solutions. These digital touchpoints would be completely trained and would be our enabling points for the rural population of India even if they are on feature phones. We focus a lot on the vernacular communication; be it our app or videos to explain the features/usage with utmost simplicity. This would create a sustainable business model for our digital touchpoints along with a mutually trustworthy business environment.

Digital payment market in India is one of the largest and fastest growing markets. We were successful to be positioned as Number 1 Balance Checking Utility App in Google Play store. As a next step, we are looking for financial partners wherein we can explore the database and mutually provide different services to our user base through our digital touchpoint network and alternative Credit scoring system. Our roadmap aligns to our mission to provide various financial services to the next billion offline- banked users.

What are the security standards followed by True Balance? How are the developers ensuring that customers' records and mobile payments are safe and secure?

As with most of the business models in India and especially when you deal with fintech; one cannot ignore the importance of security. We have a highly secure localized database system, regular audits, automated alerts running periodically and round the clock dedicated teams to keep a constant check for fraud, cherry pickers, any deviations or suspicious activities. Through instant alarming and messaging systems we are able to fix any such instances in real time and we have never experienced data loss. We are on a constant spree to strengthen security both for our internal systems and for our users to ensure that their money and transactions are safe with us.

What more can we expect from True Balance in addition to 'Refer and earn' model, Data usage feature, Mobile payments, etc?

With the fresh funds coming in Wallet has been a cohesive part to boost the vision of the company which is to touch the Next Billion users and create financial freedom. So, for the next 2-3 years, we want to be the financial platform in India. Payment, transfer, and loan are the three major areas we are focused on. Our revenues from our current service line have seen a steady rise since the wallet has been launched. True balance is coming up with the small-loans concept to focus on the deemed market of 2022 of $3.5 trillion markets. This will enable users in the rural area to enjoy the financial services even if they don't have bank accounts. This strategy will help to augment advantages of financial services to the Indian audiences.

What will be your go-to-market strategy to reach out to rural India? Are you looking for partnering with other organizations?

We run a special marketing activity called Member Get Member (MGM). If the True Balance app is referred to a friend, then both parties can earn some free points. So, most of our users use the MGM marketing which in turn eventually leads to an increase in our user base. As such our user base has been increasing steadily not only through the google play store but the user acquisition happens through our own MGM channel.

We are looking for a partnership with other entity in terms of Travel and Hotel bookings, Insurance, E-commerce and Recharge loans.

What are the important offerings from True Balance in terms of products and services which you think that will really benefit the consumers across the country?

True balance is planning to foray into new business segments like E-commerce on the handset, Insurance, Recharge loan and Travel and Hotel booking etc. The programme aims at enabling all True balance customers to get benefits with each service. Anything related to small finance which is fit to our customer character and nature is our focus right now and that will be our area of concentration.

What are your key focus areas for India? What kind of customers do you have in India?

Last year, we were focused on increasing our user base and then our usability. Our company got the PPI license in July 2017 and we launched our wallet in Nov 2017. This year, we are in the transition period from being a utility provider to a financial provider. Our focus for the next 2-3 years would be to provide small finance to people in India. Payments, transfers, and loans are the three major areas we are focused on. Our target audience would be the rural parts of India and our userbase are based in tier 2 and 3 cities, but now we have also started providing a postpaid balance check and other features like DTH, electricity and gas payments.

Verdict

True Balance seems to work in the right direction to emerge as a wholesome mobile wallet to meet the demands of Indian mobile users. The app has recently completed their KYC registration. This development will help users fetch more use cases from the app and will allow them to have 'unlimited spending money'. If you use mobile wallets in everyday use, you can give True Balance a try. Let us know your experience with the application and what extra features you find helpful in your everyday routine.

-

99,999

-

1,29,999

-

69,999

-

41,999

-

64,999

-

99,999

-

29,999

-

63,999

-

39,999

-

1,56,900

-

79,900

-

1,39,900

-

1,29,900

-

65,900

-

1,56,900

-

1,30,990

-

76,990

-

16,499

-

30,700

-

12,999

-

18,800

-

62,425

-

1,15,909

-

93,635

-

75,804

-

9,999

-

11,999

-

3,999

-

2,500

-

3,599