Just In

- 4 hrs ago

- 4 hrs ago

- 22 hrs ago

- 22 hrs ago

Don't Miss

- News

Re-Polling In Tamil Nadu After Annamalai Claims 1 Lakh Names Missing In Voters' List? EC Reacts

Re-Polling In Tamil Nadu After Annamalai Claims 1 Lakh Names Missing In Voters' List? EC Reacts - Sports

KKR vs RCB My11Circle Prediction IPL 2024 Match 36: KOL vs BLR Fantasy Tips & Expert Picks

KKR vs RCB My11Circle Prediction IPL 2024 Match 36: KOL vs BLR Fantasy Tips & Expert Picks - Movies

Cannes 2024 Poster: Akira Kurosawa's Enthralling Magic On Official Poster Leaves Fans Saying 'Sublime'

Cannes 2024 Poster: Akira Kurosawa's Enthralling Magic On Official Poster Leaves Fans Saying 'Sublime' - Finance

1:10 Split, 1 Bonus, 23 Dividend: Crorepati Stock, Tata's Gems & Jewellery Turns Rs 25K To Rs 2 Cr; BUY In Apr

1:10 Split, 1 Bonus, 23 Dividend: Crorepati Stock, Tata's Gems & Jewellery Turns Rs 25K To Rs 2 Cr; BUY In Apr - Automobiles

Next-Gen Maruti Suzuki Dzire To Get More Features & Unique Styling – Check Out All The Details Here

Next-Gen Maruti Suzuki Dzire To Get More Features & Unique Styling – Check Out All The Details Here - Lifestyle

Summer Fashion: Your Bollywood-Style Ethnic Outfits Guide For Sun-kissed Sophistication

Summer Fashion: Your Bollywood-Style Ethnic Outfits Guide For Sun-kissed Sophistication - Education

Assam Class 10 Result 2024 Declared: Anurag Emerged as the Top Performer With 593 Marks

Assam Class 10 Result 2024 Declared: Anurag Emerged as the Top Performer With 593 Marks - Travel

Journey From Delhi To Ooty: Top Transport Options And Attractions

Journey From Delhi To Ooty: Top Transport Options And Attractions

Flipkart Money: 7 Facts to be Aware off before you start using it

Flipkart has now launched a new wallet called the Flipkart Money. This new move by the largest e-commerce giant in India is an attempt to revamp their existing by semi-defunct wallet.

Well, you might already be wondering what is so cool about the Flipkart. Here is a list of 7 facts that you should be aware of before us start using the wallet.

Payment firm FX Mart power Flipkart Money

The recently launched Flipkart Money is powered by the payment firm FX Mart. It's worth noting that the India's largest e-commerce marketplace had a semi-defunct wallet in its website for some time, however the utilities were limited refunds in the form of wallet balance for shopping done through WS Retail, a seller which the company had set up to navigate FDI restrictions.

Flipkart acquired FX Mart last year

Exactly five months back Flipkart acquired a major stake in Punjab based payment firm FX Mart. According to a report by Mint, Flipkart had paid Rs 45.4 crore for the stake which empowered the company to place two of its top executives on the board of FX Mart.

Presently available only on Android

Flipkart Money is available only in the Android app as of now, however the e-commerce giant claim that they will soon launch their wallet in iOS and Windows. The company though haven't given any time frame for such a launch.

Now make purchases from 3rd party seller using Wallet

Post the launch of Flipkart Money users can use their refunded money to make purchases on sellers other than WS Retails. Previously Flipkart allowed users to use the money only for purchases through the aforementioned retailers.

May require KYC documents for activation

The FAQs section regarding Flipkart money on the company website state that users may be required to submit their KYC documents if required. Besides that, Flipkart reserves the right to cancel the wallet of any users if incorrect documents are furnished.

Max Bank Transfer capped at Rs 25,000 per month

It's worth noting that the Flipkart Money has some transactional restrictions that you should be aware of. According to the FAQs section Flipkart Money balance can't cross Rs 10,000 with top-ups not exceeding Rs 10,000 per month. Apart from that transfers from Flipkart Money to user's bank accounts are restricted between Rs 5,000 per transaction and Rs 25,000 per month. This is quite a bummer considering the fact that you have received refunds for you MacBook worth a Rs 60K, because then you would be required to transfers funds in parts.

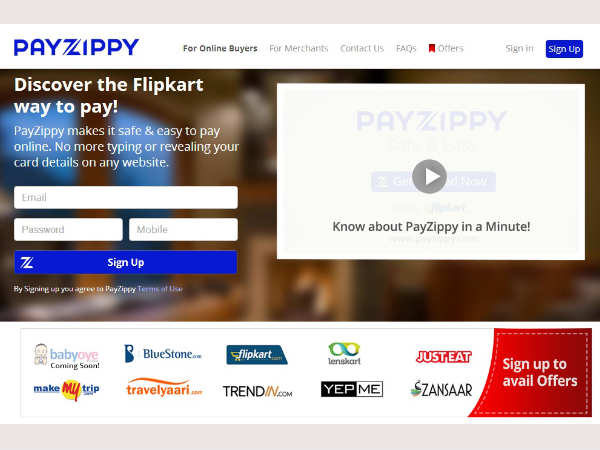

This isn't the first time Flipkart is doing this

Many of you would be unaware of the fact that Flipkart had applied for a license for setting up a wallet back in July 2013, through its payment gateway business Payzippy. Unfortunately, though the company failed to secure a license from RBI. Eventually Flipkart pulled down the shutters to Payzippy payment gateway business in November last year.

-

99,999

-

1,29,999

-

69,999

-

41,999

-

64,999

-

99,999

-

29,999

-

63,999

-

39,999

-

1,56,900

-

79,900

-

1,39,900

-

1,29,900

-

65,900

-

1,56,900

-

1,30,990

-

76,990

-

16,499

-

30,700

-

12,999

-

18,800

-

62,425

-

1,15,909

-

93,635

-

75,804

-

9,999

-

11,999

-

3,999

-

2,500

-

3,599