Just In

- 23 min ago

- 1 hr ago

- 1 hr ago

- 3 hrs ago

Don't Miss

- Education

UPSC Civil Services Result 2023 to be declared soon; Know How to check CSE results

UPSC Civil Services Result 2023 to be declared soon; Know How to check CSE results - Finance

Bank Of India Join Hands With IMGC To Offer Mortgage Guarantee-Backed Home Loans

Bank Of India Join Hands With IMGC To Offer Mortgage Guarantee-Backed Home Loans - Sports

Sanju Samson Record vs KKR & Stats At Eden Gardens Ahead Of IPL 2024 Match 31

Sanju Samson Record vs KKR & Stats At Eden Gardens Ahead Of IPL 2024 Match 31 - Movies

Love Sex Aur Dhoka 2: Swastika Mukherjee Upset Over Leaked Video, Makers Try To Take It Down

Love Sex Aur Dhoka 2: Swastika Mukherjee Upset Over Leaked Video, Makers Try To Take It Down - News

BJP MP Tejasvi Surya Heckled In Bengaluru Over Guru Raghavendra Bank Scam

BJP MP Tejasvi Surya Heckled In Bengaluru Over Guru Raghavendra Bank Scam - Automobiles

Namma Yatri's Innovative Zero Commission Cab Service Launches In Bengaluru

Namma Yatri's Innovative Zero Commission Cab Service Launches In Bengaluru - Lifestyle

Ranveer Singh-Kriti Sanon Dazzle In Manish Malhotra Banarasi Weave Outfits In Kashi, Watch Video!

Ranveer Singh-Kriti Sanon Dazzle In Manish Malhotra Banarasi Weave Outfits In Kashi, Watch Video! - Travel

Maximise Your First Indian Adventure With These Travel Tips

How to Transfer Money Using USSD Payment Method? 6 Tips to Get you Started

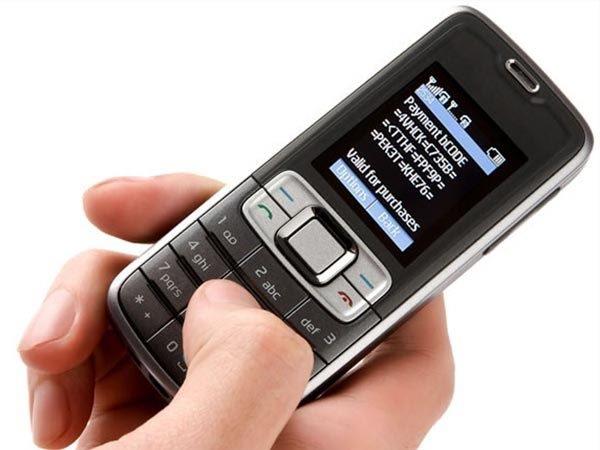

Not every person has a smartphone or an access to the internet. As such, USSD-based mobile banking can easily help people with their transaction.

Following the demonetization of Indian 500 and 1,000 rupee notes, the Government is now preaching on using more of digital devices, mainly the feature mobile and smartphones for various transaction activities.

As such, India might be gradually moving towards becoming a cashless economy and PM Narendra Modi's dream of Digital India might become a reality.

SEE MORE: Is BJP Attempting to Make India a Cashless Country? Find out Here

Besides, due to the cash crunch situation and the shortage of new currency notes, a lot of smartphone users have already moved to digital wallets for paying the shopkeepers, service providers and more.

Customers are also adopting UPI-based apps in their smartphone to easily pay for services, send and receive funds.

But the what happens considering the people from rural areas. They usually do not have a smartphone nor have access to the internet. As such, USSD-based mobile banking can help people with their transaction.

So, if you happen to be wondering how can you use USSD-based mobile banking? Here are few tips and guidelines which if you follow might help you in using the service for carrying out different banking activities.

Getting Started with USSD Banking

Well, the first thing you need to do is make sure your mobile number is registered for mobile banking. In case your number isn't registered, you'll have to visit the bank and fill up a form to register and link it with your bank account.

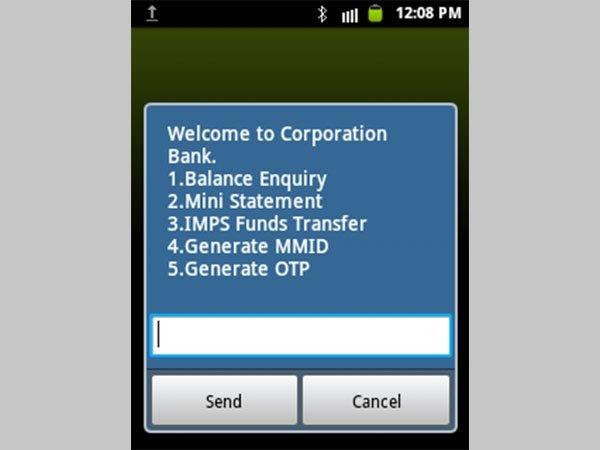

So after the registration is complete you'll have to generate Mobile Money Identifier (MMID) number which usually is issued by the bank.

Using another method, by sending an SMS, or by logging into your bank's internet banking portal you can also retrieve the MMID.

In addition with the MMID, users also need the MPIN (a four-digit code to authorize transitions). Once you get the default MPIN, you can change it to any four digits of your choice.

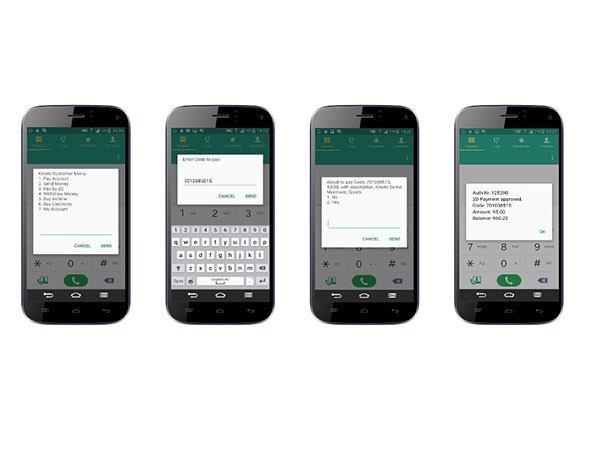

The Process

So to begin with, open the dialer app on your phone, type *99# and dial. After that, you will see the welcome screen after which you will have to enter first three letters, or IFSC code or 2-digit bank code followed by send.

For State Bank of India (SBI), the three letters will be SBI, for ICICI Bank ICI, and so on. In case of IFSC code, State Bank of India has SBIN, ICICI Bank has ICIC, HDFC Bank has HDFC etc.

So, if you have your mobile banking registered with SBI bank, type SBI or SBIN and tap send. After verifying your phone number and bank details, a sub-menu will pop up. When this screen appears, you will have options to check your account balance, check mini statement, or send money using MMID or IFSC.

If you want to check your account balance, enter ‘1' in numerical and tap send, similarly for a mini statement, enter ‘2' and tap send. Likewise, you can conduct other activities following the options that are given.

Transferring Money Using USSD Short Codes

In order to transfer the money, dial *99#, type bank name, and when the interface opens, enter ‘3' and tap send. Now, enter the beneficiary's mobile number and the beneficiary MMID, which you will have to get from the person.

After that, you need to enter amount and remarks which should be separated by space. As part of the final step, you will have to enter your MPIN to authorize the transaction and last 4 digits of your account number, and tap on send.

So now once your transaction is authorized, the money will be instantly credited to the recipient's account.

SEE ALSO: Reliance Jio Effect: Airtel, Vodafone and BSNL will Now Offer Combo Plans

USSD Banking Limitations

So you really have to pay attention and be quick because once the USSD popup notification arrives, you have to respond within 10 seconds, or the process will get cancelled.

If you fail to input the required option then you may have to start all over from the beginning stage. It can sometimes be a tedious task.

Click Here for New Smartphones Best Online Deals

Regional Language Support in USSD

As the USSD service is looking to facilitate easier mobile banking for rural users, especially the non-English speaking ones, the service is available in 11 regional languages.

The service can be accessed in the desired language using the following short codes. Hindi (*99*22#), Marathi (*99*28#), Bengali (*99*29#), Punjabi (*99*30#), Kannada (*99*26#), Gujarati (*99*27#), Tamil (*99*23#), Telugu (*99*24#), Malayalam (*99*25#), Oriya (*99*32#) and Assamese (*99*31#).

USSD Banking Daily Transaction Limit and Charges

The Reserve Bank of India (RBI) has stated that the USSD payment method can be used for sending money as low as Re 1, and as much as Rs 5,000 per transaction.

Nonetheless, users will be charged Rs 0.50 per transaction, which will be added on their mobile bill. The service works 24 hours a day and 7 days a week.

However, following the cash crunch situation, carriers have waived off the transaction charges till December 31.

Click Here for New Smartphones Best Online Deals

-

99,999

-

1,29,999

-

69,999

-

41,999

-

64,999

-

99,999

-

29,999

-

63,999

-

39,999

-

1,56,900

-

79,900

-

1,39,900

-

1,29,900

-

65,900

-

1,56,900

-

1,30,990

-

76,990

-

16,499

-

30,700

-

12,999

-

3,999

-

2,500

-

3,599

-

8,893

-

13,999

-

32,999

-

9,990

-

12,999

-

25,377

-

23,490