Just In

- 12 hrs ago

- 14 hrs ago

- 14 hrs ago

- 15 hrs ago

Don't Miss

- Finance

FREE, FREE, FREE! 3:1 Bonus: Pharma Stock Hits Back-To-Back Upper Circuits; 500 Shares To Earn Rs 1,69,500

FREE, FREE, FREE! 3:1 Bonus: Pharma Stock Hits Back-To-Back Upper Circuits; 500 Shares To Earn Rs 1,69,500 - Sports

Manchester City vs Chelsea LIVE Streaming: Where to Watch FA Cup Semi-Final in India, UK, USA and Other Countries

Manchester City vs Chelsea LIVE Streaming: Where to Watch FA Cup Semi-Final in India, UK, USA and Other Countries - Movies

Pukaar Dil Se Dil Tak Promo: Sayli Salunkhe Impresses In First Video Of Sony TV Show, Details About Her Role

Pukaar Dil Se Dil Tak Promo: Sayli Salunkhe Impresses In First Video Of Sony TV Show, Details About Her Role - Lifestyle

Golden Rules To Follow For Happy Marriage For A Long Lasting Relationship

Golden Rules To Follow For Happy Marriage For A Long Lasting Relationship - News

Chinese President Xi Jinping Orders Biggest Military Reorganisation Since 2015

Chinese President Xi Jinping Orders Biggest Military Reorganisation Since 2015 - Education

Exam Pressure Does Not Exist; Studying Punctually is Crucial; Says Aditi, the PSEB 2024 Topper

Exam Pressure Does Not Exist; Studying Punctually is Crucial; Says Aditi, the PSEB 2024 Topper - Automobiles

Suzuki Swift Hatchback Scores 4 Star Safety Rating At JNCAP – ADAS, New Engine & More

Suzuki Swift Hatchback Scores 4 Star Safety Rating At JNCAP – ADAS, New Engine & More - Travel

Journey From Delhi To Ooty: Top Transport Options And Attractions

Journey From Delhi To Ooty: Top Transport Options And Attractions

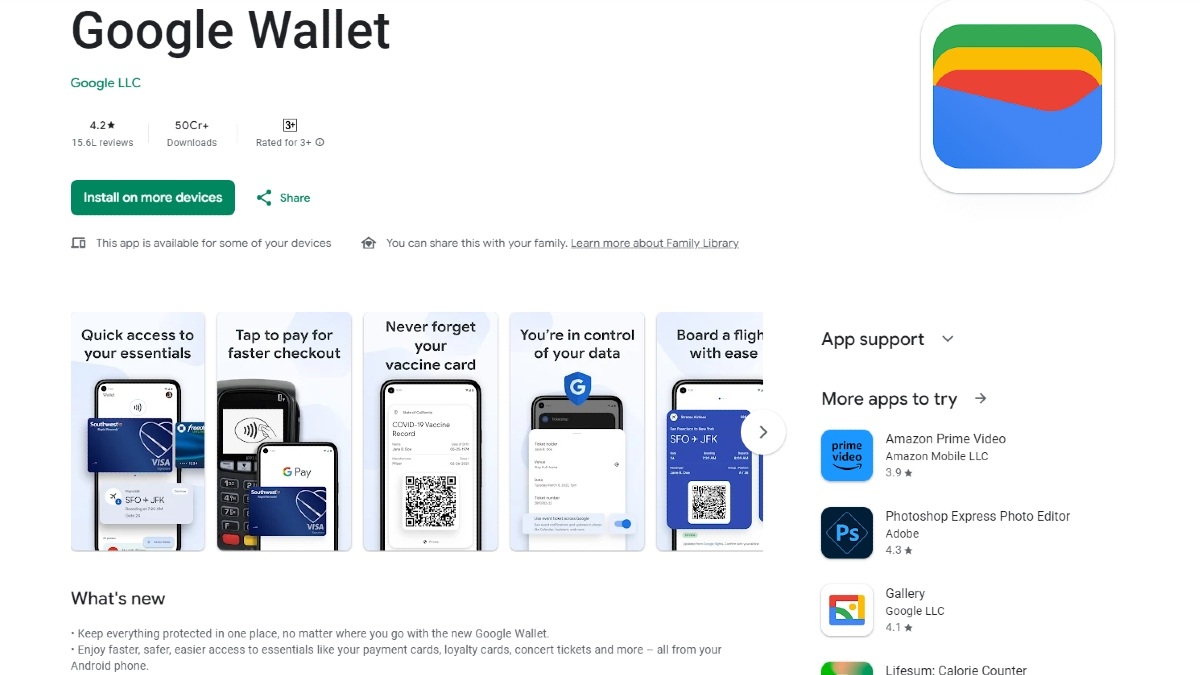

Aadhaar linking with digital wallets: Deadline and other details you need to know

The advent of mobile wallets over the last few years has changed the dynamics of cash flow and has snatched smartphones away from the clutches of just the tech savvy and has made it accessible and available to a wider range of people than before.

“Please update your KYC de…” If you, like many, are part of the tribe who have stopped reading this sentence completely when it pops up every time you use your e-wallet to pay for something or transfer funds online, you might wish to learn about what would happen if you choose not to update your details before the KYC deadline.

How Do You update your KYC?

If you have already added money to your wallet, you won’t be losing this, but you will not be able to use certain features which you might have grown used to over time. All e-wallet companies, in addition to Aadhar card, are willing to accept the following documents for verification:

1) Passport

2) Driving license

3) Pan Card

4) Election ID Card

Why Isn’t It Mandatory?

If you wish to keep your personal details private or if you are uncomfortable sharing your information with an organization that isn’t a bank, you need not worry about being blacklisted from wallets or worry about losing money that you already added. According to a statement released by RBI deputy governor BP Kanungo, the users who do not wish to complete their KYC will not lose their money.

“Reloading of the PPI and remittances can resume after completing the KYC requirement. They (customers) can continue to undertake transactions for purchase of goods and services as thereto to the extent of available balance in the PPI.”

Vodafone mPesa

Vodafone mPesa users will be unable to add money to their accounts but they will still have the option of recharge and use additional features that are available. Your money will not be blocked in any way.

Paytm

Paytm, unlike most other apps, still allows you to add money to your wallet. You will be able to spend the amount available in your wallet on vendors and products listed in the app without completing your verification. However, the downside is that you will not be able to send money to other users or transfer any funds directly to bank accounts.

Reliance JioMoney

The restrictions imposed by Reliance JioMoney on its users leaves you with the option of recharging and nothing much else, you will no longer be able to add money to your wallets.

Amazon Pay Balance

Amazon Pay Balance users will be able to use the money that is already in their accounts but they will not be able to add more money to their wallets without completing their KYC.

-

99,999

-

1,29,999

-

69,999

-

41,999

-

64,999

-

99,999

-

29,999

-

63,999

-

39,999

-

1,56,900

-

79,900

-

1,39,900

-

1,29,900

-

65,900

-

1,56,900

-

1,30,990

-

76,990

-

16,499

-

30,700

-

12,999

-

62,425

-

1,15,909

-

93,635

-

75,804

-

9,999

-

11,999

-

3,999

-

2,500

-

3,599

-

8,893