Just In

- 8 hrs ago

- 10 hrs ago

- 11 hrs ago

- 11 hrs ago

Don't Miss

- Sports

Who Won Yesterday's IPL Match 34? LSG vs CSK, IPL 2024 on April 19: KL Rahul Stellar Batting Show Decimate Chennai Bowling

Who Won Yesterday's IPL Match 34? LSG vs CSK, IPL 2024 on April 19: KL Rahul Stellar Batting Show Decimate Chennai Bowling - Finance

Rs 17/Share Dividend: Record Date On April 26; Buy The ICICI Group Stock To Be Eligible?

Rs 17/Share Dividend: Record Date On April 26; Buy The ICICI Group Stock To Be Eligible? - Movies

Chief Detective 1958 Episode 2 OTT Release Date, Time, Platform: When & Where To Watch? What To Expect? DEETS

Chief Detective 1958 Episode 2 OTT Release Date, Time, Platform: When & Where To Watch? What To Expect? DEETS - Lifestyle

Golden Rules To Follow For Happy Marriage For A Long Lasting Relationship

Golden Rules To Follow For Happy Marriage For A Long Lasting Relationship - News

Chinese President Xi Jinping Orders Biggest Military Reorganisation Since 2015

Chinese President Xi Jinping Orders Biggest Military Reorganisation Since 2015 - Education

Exam Pressure Does Not Exist; Studying Punctually is Crucial; Says Aditi, the PSEB 2024 Topper

Exam Pressure Does Not Exist; Studying Punctually is Crucial; Says Aditi, the PSEB 2024 Topper - Automobiles

Suzuki Swift Hatchback Scores 4 Star Safety Rating At JNCAP – ADAS, New Engine & More

Suzuki Swift Hatchback Scores 4 Star Safety Rating At JNCAP – ADAS, New Engine & More - Travel

Journey From Delhi To Ooty: Top Transport Options And Attractions

Journey From Delhi To Ooty: Top Transport Options And Attractions

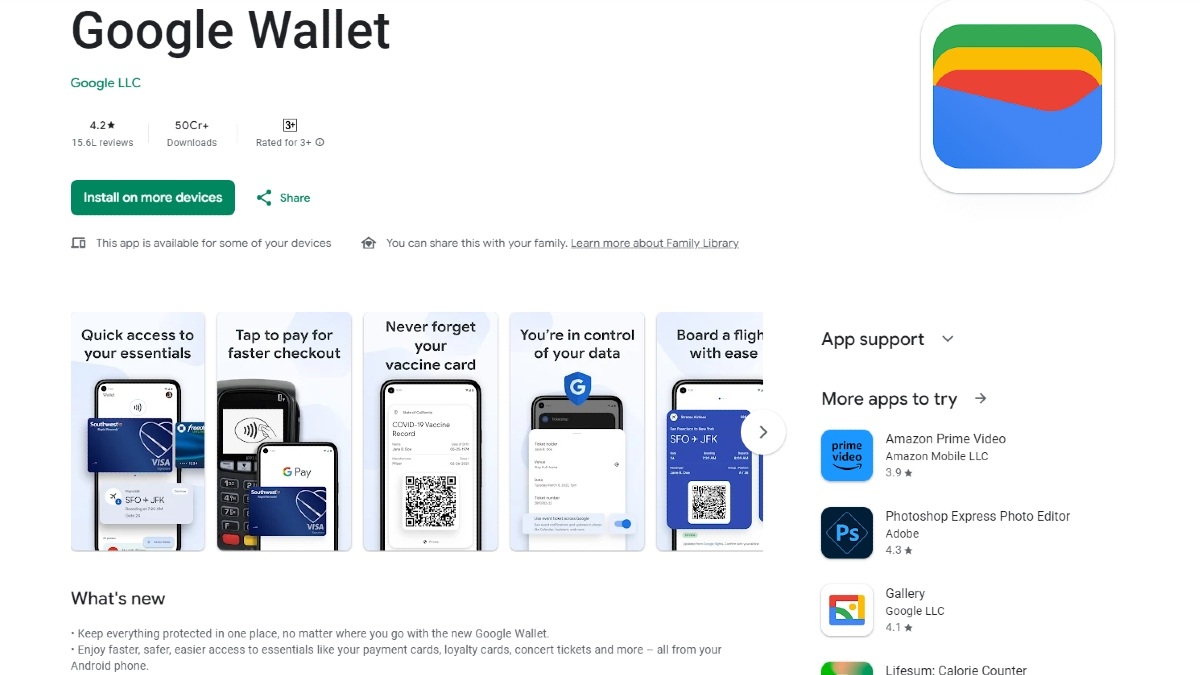

Mobile payments market to become $190 billion by 2023

These estimates are based on a study of Credit Suisse and have been mentioned in a booklet titled 'Digital Payment

Mobile payments are slated to rise from $10 billion in 2017-18 to $190 billion by 2023, Principal Adviser to Niti Aayog Ratan P Watal said today.

While, Digital payments market in India is expected to grow to $1 trillion by 2023 led by growth in mobile payments, presenting huge business opportunities for players in the digital space, he said at the launch of Niti Aayog report -- 'Digital Payments - Trends, Issues, and Opportunities.

The analysis of growth trends is based on both MeitY and RBI data. While MeitY data provides volume data in the public domain, RBI provides both volume and value data in the public domain.

A note on Data Sources is also covered in the booklet which gives a comparative picture of the data sets captured by MeitY and RBI.

These estimates are based on a study of Credit Suisse and have been mentioned in a booklet titled 'Digital Payment: Trends, Issues, and Opportunities' launched today by Ratan P. Watal, Principal Advisor, NITI Aayog and Member Secretary, EACPM, at a conference organized by FICCI and NITI Aayog.

This is the 2nd annual edition of the booklet on Digital Payments which was published in July 2017.

Furthermore, the Unified Payments Service (UPI) and Immediate Payment Service (IMPS) segments in terms of volume registered a spectacular growth during 2017- 18.

UPI, despite being a new product in the payment segment, has shown a great adoption rate among consumers and merchants.

Watal said total card payments continued its growth momentum and exceeded the trend growth rate of the last five years both in volume and value terms.

The key messages of the booklet on Digital Payments are:

1 The growth momentum of Digital Payments in Volume and Value sustained post Demonetization.

2 Spectacular Growth in New Products like UPI.

3 Steps were taken to bring in a New Regulatory Regime as per Watal Committee Report.

4 RBI has taken four key initiatives to usher in a new era of Digital Payments.

5 World of Opportunities ahead for Fintech Players.

In conclusion, Watal remarked that the proposed changes in the regulatory framework, entry of global giants and the advancement of technology will drive the future growth of Digital Payments in the Country.

-

99,999

-

1,29,999

-

69,999

-

41,999

-

64,999

-

99,999

-

29,999

-

63,999

-

39,999

-

1,56,900

-

79,900

-

1,39,900

-

1,29,900

-

65,900

-

1,56,900

-

1,30,990

-

76,990

-

16,499

-

30,700

-

12,999

-

62,425

-

1,15,909

-

93,635

-

75,804

-

9,999

-

11,999

-

3,999

-

2,500

-

3,599

-

8,893